Enterprise Debt Portfolio Management Platform

A Wall Street FinTech startup modernizing enterprise debt investing and management by coupling the world’s first and largest debt-focused AI SaaS platform.

Year

2022 - Present

Team

1 designer, 6 engineers

My Role

UX/UI Designer

Tools

Figma

Imagine being a CFO or Fund Manager who just signed a $200M debt deal. Fancy right?

Wrong! You have a pdf file. You send hundreds of emails and numerous phone calls to communicate with your team and send multiple duplicates of the agreement.

Worse, you print out the agreements because you need to make notes on post its and take the folder with you on vacation.

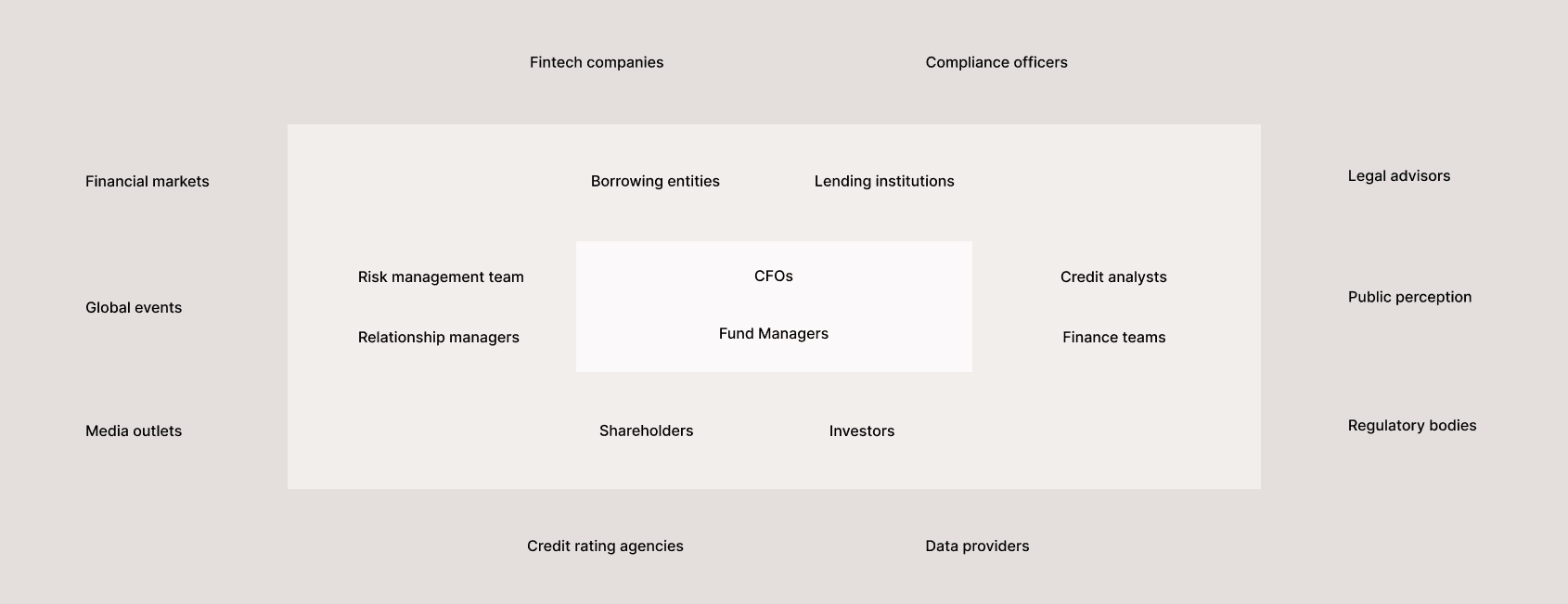

The Big Picture

Stakeholder Mapping

Where in the deal cycle does CredCore belong?

Post deal phase

Distribution of funds

Fund distributed as per agreement.

Compliance

Borrower must adhere to the covenants and conditions specified in the agreement.

Communication

Regular interaction with lender to update on company’s financial health.

Repayment

Makes regular payments as per the agreement terms.

Renegotiation

If necessary, a new agreement can be made with updated terms and conditions.

Basically, we help funds (lenders) manage their investments and enterprises (borrowers) manage their loans.

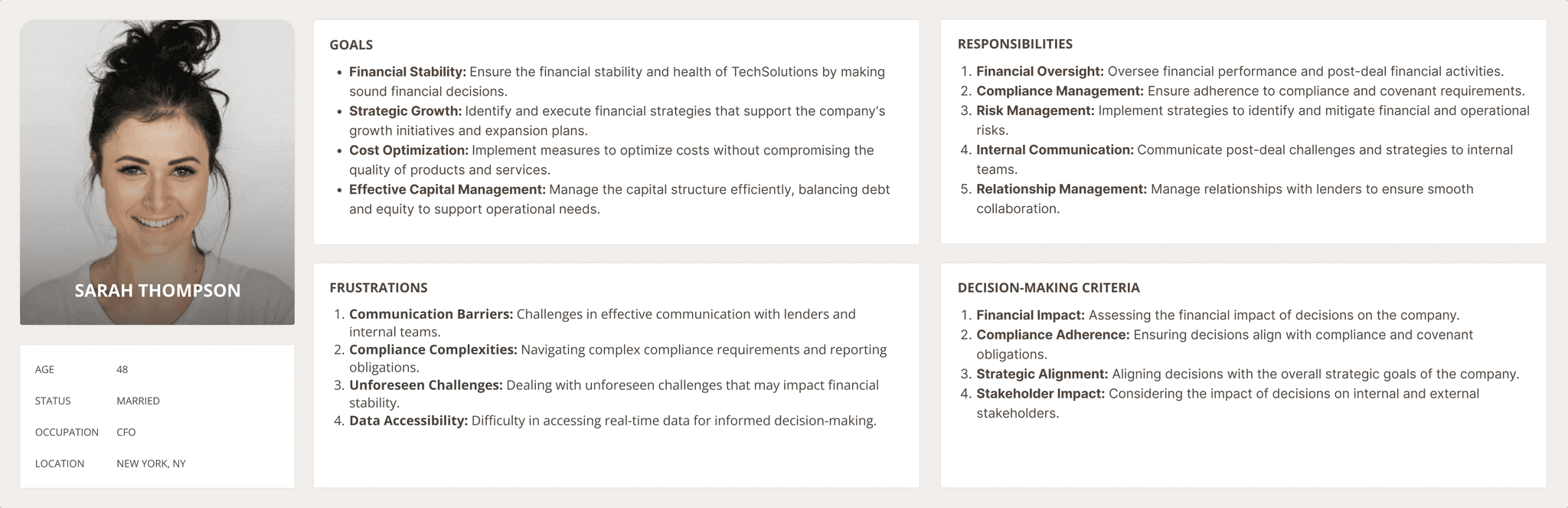

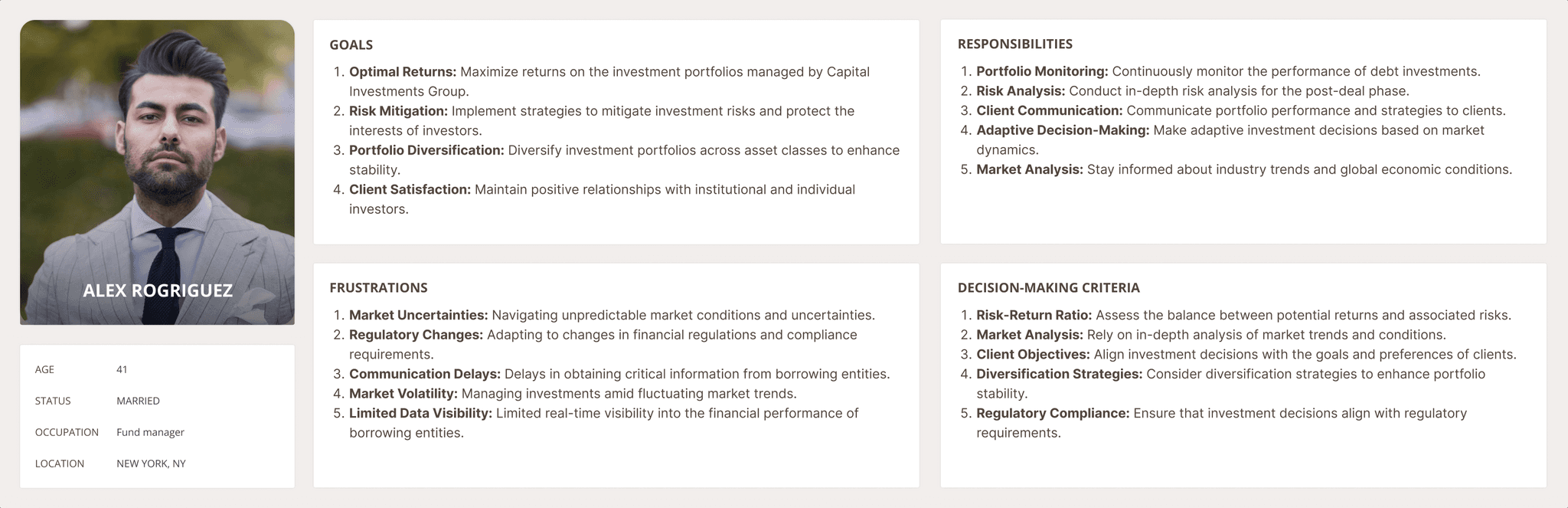

Who are our primary users?

CFOs:

Oversee the financial strategy and health of the company.

Fund Managers:

Oversee investment portfolios, including corporate debt, on behalf of institutional or individual investors.

Problem Statement

In post-deal phase of the corporate debt cycle, a critical challenge emerges as borrowers and lenders grapple with inefficient communication channels and lack of real-time visibility into financial performance. The absence of streamlined and transparent communication mechanisms results in delays in addressing emerging issues, leading to increased operational risks and potential financial setbacks for both parties. Additionally, the absence of a unified platform for data sharing and collaborative decision-making impedes the ability of borrowers and lenders to proactively navigate unforeseen challenges, hindering the post-deal success and sustainability of corporate debt agreements.

MVP Success

Goal

Our goal is to provide a centralised platform for CFOs and Fund Managers to manage their debt agreement and easily navigate around the document.

Success

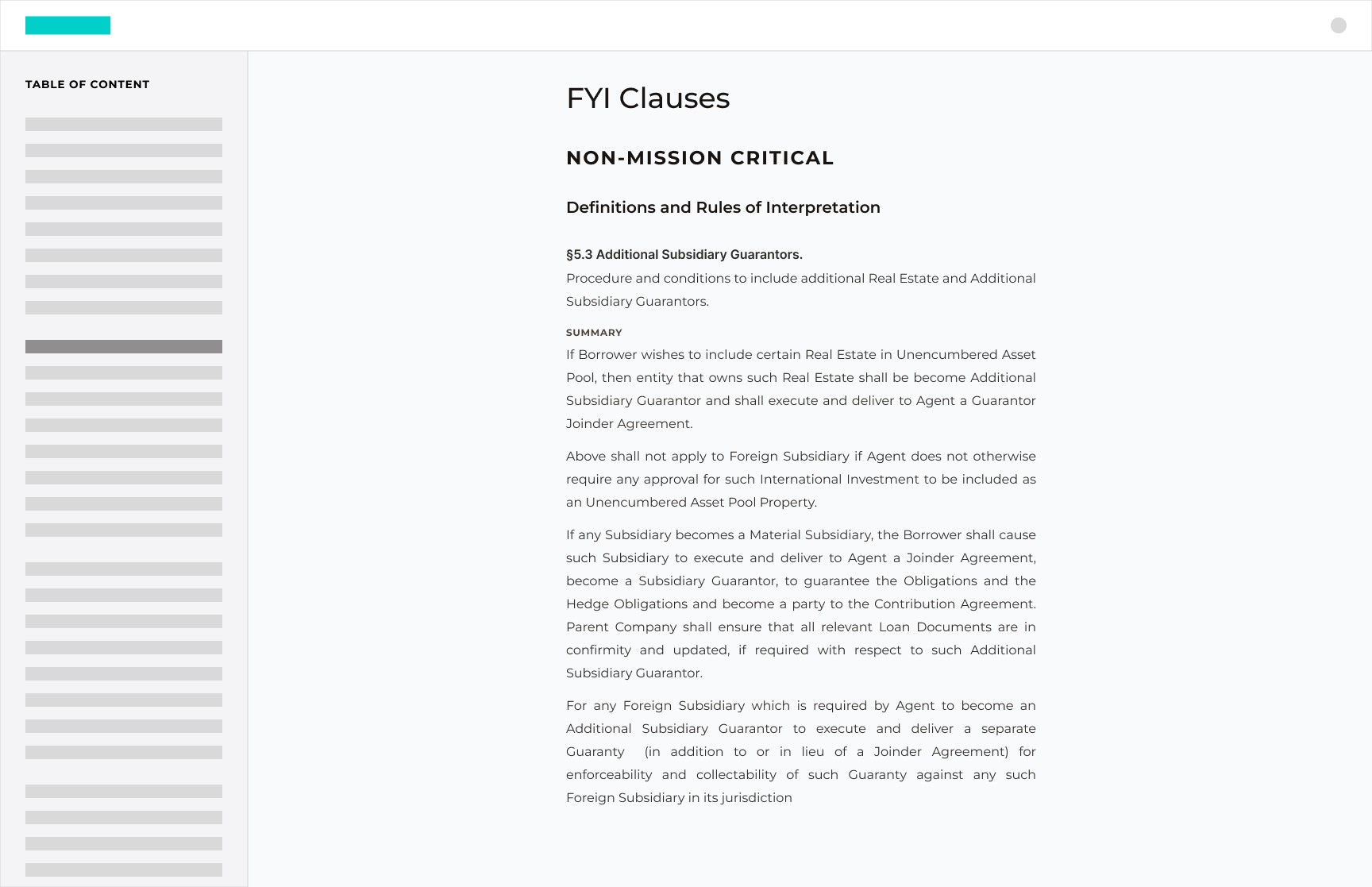

Easy Navigation

Table of content can be interactive for quick and easy access to different parts of the document

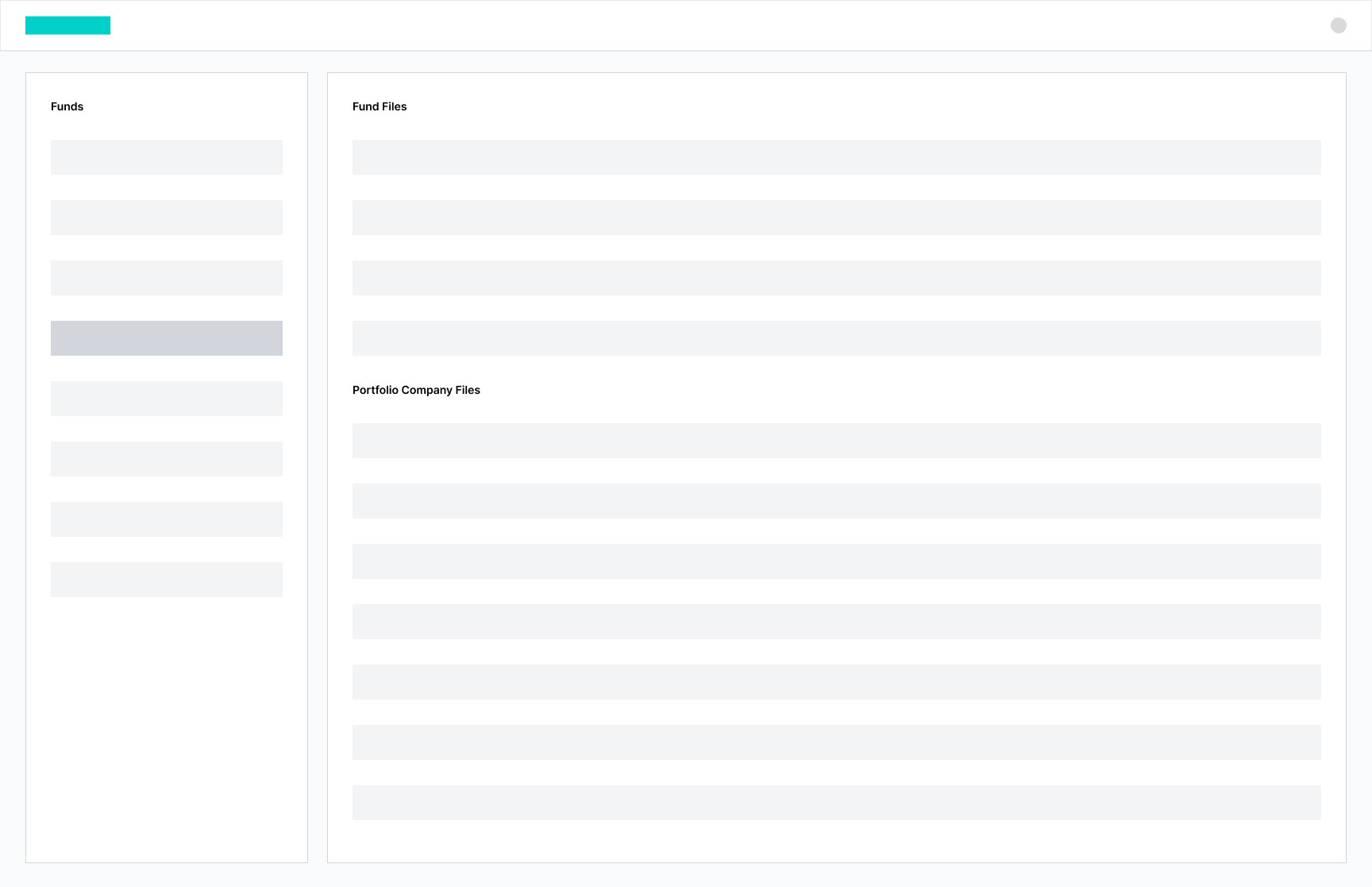

Centralized Platform

Organize multiple debt agreements by the portfolio company and/or fund

Design, AI, engineering and business teams got together and decided to convert pdf to html format for easier parsing.

I started with a simple skeleton structure for the viewer and iterated my way to the final design

PDF challenges

Poor navigation

Lack of discoverability of ToC

Cumbersome, lengthy, hard to read texts

Lo-fi Wireframe

Breathing space for text for better visual quality.

Typography hierarchy to clearly separating clauses from headings

Table of Content navigation panel

To make a centralised platform for all debt agreements, we need a home screen from where the agreement documents can be easily accessed

The organisational structure of how debt deal work:

Funds (can have agreements)

Portfolio Companies

Documents

Simple Flow

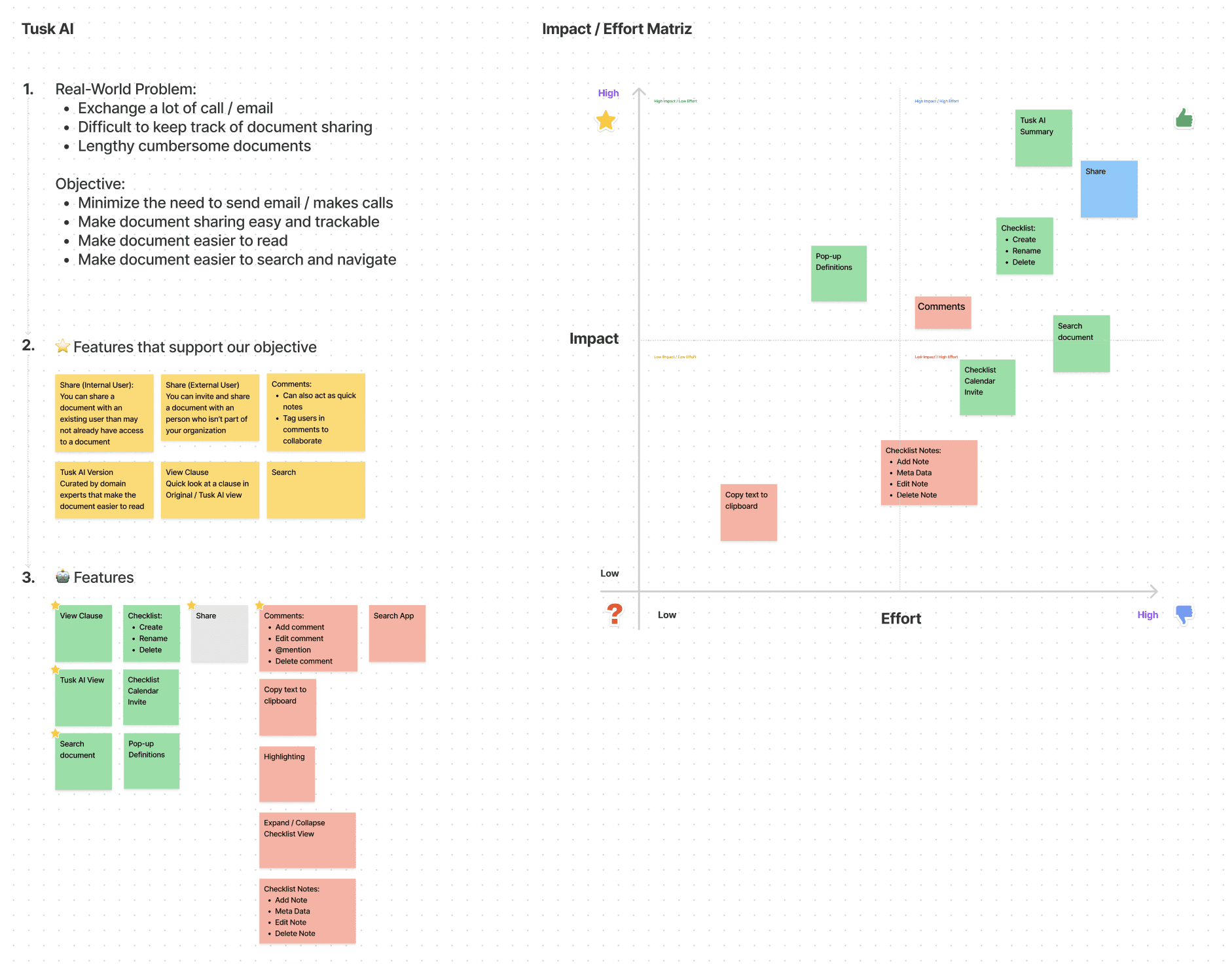

Client Requirements and Impact/Effort Metric - Phase 1

"We have to keep a checklist of clauses to be monitored weekly, bi-weekly, monthly etc. Do you folks have that?"

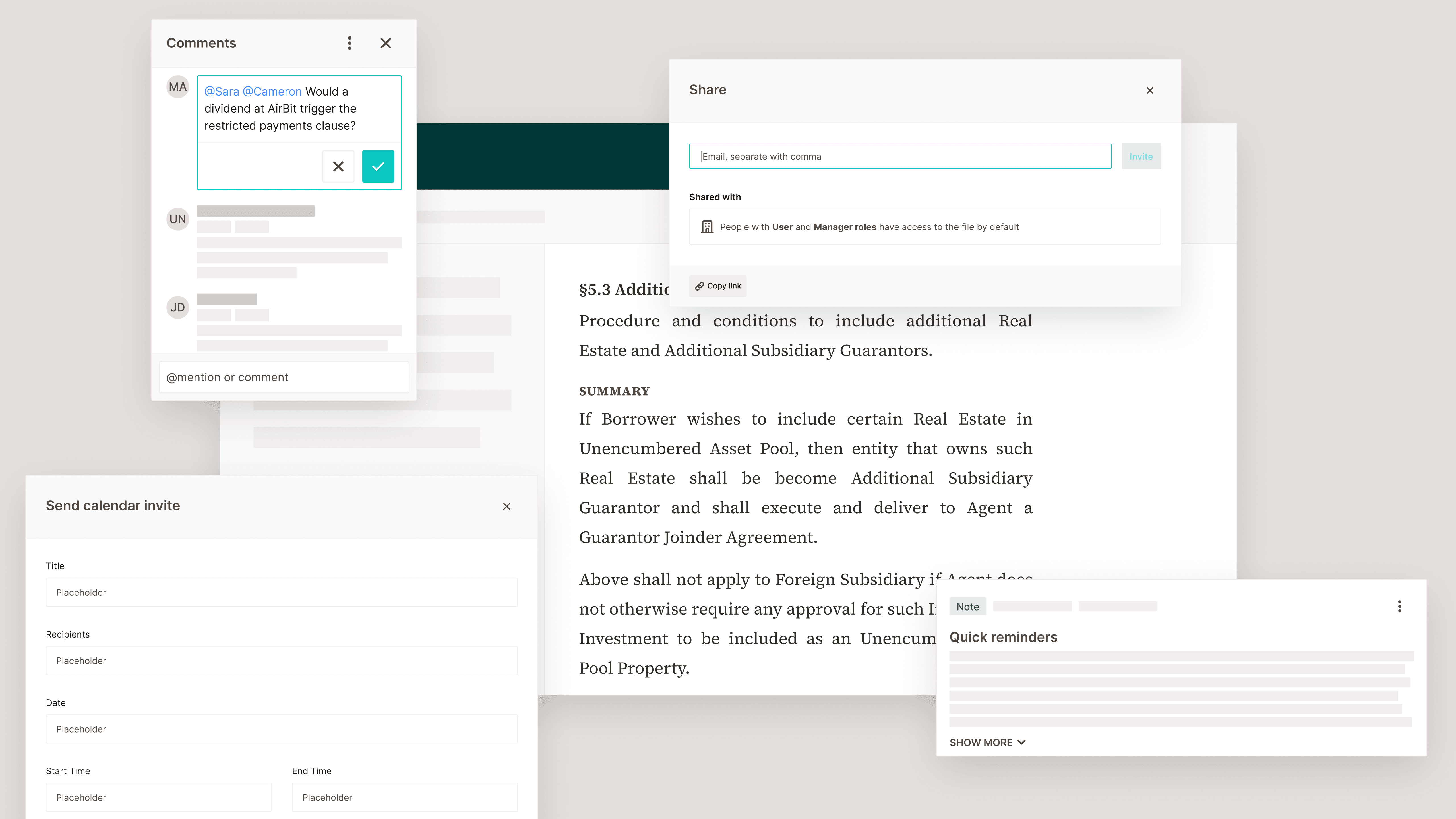

"I want to be able to take short notes or even tag a team member to any of the clauses or sections. Is that possible?"

"Instead of sending files over emails, can I share the file within the system? It'll make life easier"

"Some of these clauses are too long and cumbersome. Can we get a summary of the clauses for each document?"

"I still need to go to the top of the page for definitions. I lose context jumping back and forth. Can I see the definition of the term on demand?"

Goal

To provide a collaborative platform for CFOs and Fund Managers to easily communicate with their team on any given agreement, keep a track of all the important covenants and a summary of all the clauses in the agreement

Design Challenges

Textual Hierarchy

We wanted to summarise it for better comprehension so differentiate between elements like title, header, clause and body text.

Modular design

As the requirements can increase, we wanted create a modular design to be able to handle any urgent feature requests from clients.

Constraints

Development Timeline

My challenge was to build a design patterns and components that fasten the development process so it can be quickly iterated.

AI summarization

Long texts are cumbersome to read. I had to work with the AI team to design clauses on a high level description and bullet points way.

Design Principles Applied

Easy to use

Since our personas were above 45 years of age, we wanted to keep the visuals simple and navigation easy to understand.

Notification and feedback

Any action taken on the platform, had to have a feedback for the user so they understand they next step, error or success of their actions.

Modularity and scalability

Some features had to be prepare for demo purpose only. We decide to keep a modular design that can be easily moved around for scalability.

Design in context

There is no competition for this product, yet. Since there was no reference, we decided to design strictly for the context of the business.